Osmium, one of the rarest and densest elements on Earth, has piqued the interest of industries and investors alike for its unique properties and limited availability. Known for its robustness, high melting point, and resistance to corrosion, osmium is primarily used in applications that require extreme durability, such as in the production of hard alloys, electrical contacts, and in certain medical and scientific instruments. This report delves into the key factors influencing the price of osmium, recent price trends, and projections for the future, providing valuable insights for investors, industrial stakeholders, and market analysts.

1. Understanding the Rarity and Demand for Osmium

The scarcity of osmium is unparalleled—its occurrence in the Earth’s crust is roughly 50 parts per trillion, making it one of the rarest metals. This rarity naturally drives high prices, with additional cost escalations due to extraction challenges. Osmium is most often derived as a byproduct of platinum and nickel mining, particularly in regions like South Africa and Russia. Given these constraints, the osmium market is closely linked to the supply and demand dynamics of these other metals, adding an additional layer of complexity to its price trend.

Request For Sample: https://www.procurementresource.com/resource-center/osmium-price-trends/pricerequest

In recent years, there has been a significant uptick in demand for osmium, particularly in specialized industries. Besides its application in hard alloys and chemical catalysts, osmium is gaining traction in high-end jewelry and watchmaking due to its iridescent sheen and durability. With the emergence of new use cases and its growing appeal as a rare asset class, the demand for osmium is expected to continue on an upward trajectory.

2. Historical Price Trend of Osmium

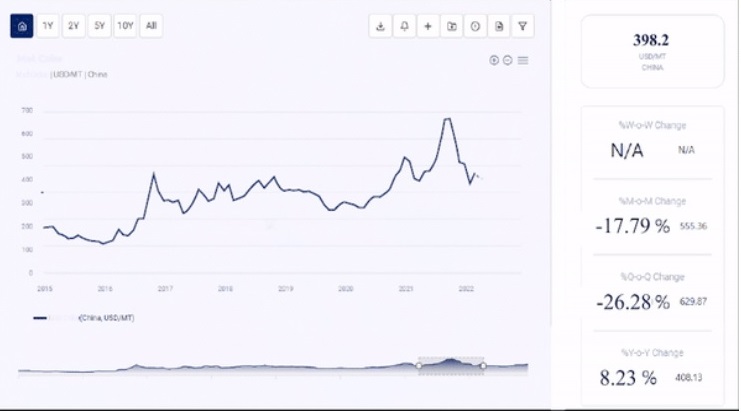

Historically, the osmium price trend has been characterized by considerable volatility. The price per ounce has seen fluctuations influenced by factors such as mining output, geopolitical issues affecting major producing countries, and shifts in demand from key industrial sectors. The chart below outlines the general historical trend over the past decade:

- 2014-2018: Prices remained relatively stable, with minor fluctuations due to steady demand and balanced mining outputs.

- 2019-2020: The osmium price experienced a spike, driven largely by increased demand from the technology and electronics sectors, coupled with a dip in supply.

- 2021-2023: Following a brief plateau, prices surged again in 2021 as disruptions in mining operations due to global geopolitical tensions impacted the supply of platinum and nickel byproducts. Demand from luxury goods and scientific research sectors continued to grow, further increasing prices.

This trend illustrates how even minor shifts in production or demand can cause significant price changes due to osmium’s rarity and the limited number of mining operations focused on this metal.

3. Current Osmium Price and Market Drivers (2024)

As of early 2024, osmium prices have remained elevated, primarily due to continued supply constraints and rising demand from niche markets. Major drivers influencing the current price include:

-

Supply Constraints: With most osmium being sourced as a byproduct of platinum mining, any disruption in platinum production directly impacts osmium availability. Recent mining strikes and operational issues in South Africa, one of the leading sources of platinum, have limited osmium supply, putting upward pressure on prices.

-

Growing Demand from Luxury Sectors: The luxury jewelry and watch industries have shown a rising interest in osmium, promoting it as an exclusive metal with unique aesthetics and durability. This demand surge is particularly notable in European and North American markets, where osmium’s use in high-end products is rapidly expanding.

-

Increased Industrial Use: Beyond luxury markets, osmium’s application in scientific instruments, medical devices, and advanced electronics is also growing. The metal’s remarkable stability and conductivity make it an ideal choice for specialized industrial applications, further boosting demand.

4. Osmium Price Projections and Forecast

Forecasting the osmium price trajectory is challenging due to its inherent market volatility and dependency on other metal industries. However, several trends and projections can provide insight into its potential price movements in the coming years:

-

Short-Term Projection (2024-2025): Given current supply chain constraints and sustained demand from luxury and industrial sectors, osmium prices are expected to remain high in the short term. Any further disruptions in platinum mining or geopolitical issues in production regions could lead to additional price increases.

-

Mid-Term Projection (2026-2028): Over the medium term, osmium prices could stabilize as the luxury and industrial sectors adapt to supply conditions. Advances in recycling technologies may also provide an additional osmium source, helping to ease supply constraints and potentially dampening price increases.

-

Long-Term Projection (2029 and Beyond): In the longer term, osmium prices will largely depend on technological advancements in mining and recycling, as well as shifts in demand from emerging industries. As applications for osmium expand, especially in scientific research and advanced manufacturing, its value as a rare and irreplaceable metal is likely to keep prices high.

5. Factors That Could Influence Osmium Prices

A variety of external factors could impact osmium prices, including:

-

Mining Technology Innovations: Advances in extraction and refinement technologies may increase osmium yield from platinum mining operations, potentially improving supply and stabilizing prices.

-

Geopolitical Risks: As with many rare metals, osmium’s supply chain is susceptible to geopolitical risks. Any significant disruptions in major producing countries could cause abrupt price spikes.

-

Economic Slowdowns: Global economic slowdowns can impact osmium demand, particularly from luxury and industrial sectors. In times of recession, demand for high-end products tends to decrease, potentially reducing osmium prices temporarily.

-

Environmental Regulations: Stringent environmental regulations may affect mining activities, especially in regions with substantial osmium reserves. If regulatory pressures increase, mining output could decline, leading to potential supply shortages and price increases.

6. Investing in Osmium: Opportunities and Challenges

Investing in osmium presents unique opportunities and challenges. For investors seeking rare metals with potential for appreciation, osmium is an attractive asset due to its rarity and limited supply chain. Additionally, osmium’s increasing demand in luxury goods and high-tech applications makes it a valuable investment for those interested in niche markets.

However, investors should also be cautious. The osmium market is highly specialized, with fewer buying and selling opportunities compared to more widely traded metals like gold or silver. Market volatility, coupled with limited market liquidity, can pose risks for osmium investors. It’s essential for potential investors to carefully consider these factors and to stay informed on price trends and developments in osmium-producing industries.

7. The Future of Osmium Prices and Market Dynamics

Osmium’s unique properties, coupled with its extreme scarcity, make it a metal with a bright yet complex future in the market. The increasing demand from luxury and industrial applications, along with ongoing supply challenges, suggests that osmium prices may remain high in the foreseeable future. While new technologies and recycling methods could eventually alleviate some supply constraints, the intrinsic rarity of osmium will likely continue to support its value.

Contact Us:

Company Name: Procurement Resource

Contact Person: Endru Smith

Email: [email protected]

Toll-Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537171117 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA